THE TIME-MONEY-RISK TRAP

- The Core Lesson School Skipped

- The Trade-Off That Rules the System

- The Common Path to Nowhere

- Break the Pattern

- From Knowledge to Freedom

I’ve heard over a dozen versions of this:

“I waited. I thought there’d be time. Now I wish I had started years ago.”

We live in a world where investing is just a few clicks away. It’s easier than ordering takeout, and yet most people never even start.

And ironically, the people who are already behind, stretched for money, and terrified of risk… they’re the ones who won’t read this. Because they’re more concerned about which celebrity divorced or who won the game last night.

But you’re here.

You’re not ignoring the system.

You’re trying to master it.

The Core Lesson School Skipped

We go to school for over a decade.

We learn equations we forget, history we half-remember, and theories we never use.

But they never teach you the most basic equation of all:

How money, time, and risk interact.

They’re not separate levers. They form an inter-dependent relationship. Adjust one, and the others must respond.

And not just any system.

It’s the one that governs your lifestyle, your freedom, your future.

Instead of teaching this, they hand you a script:

- Get good grades

- Go into debt for a degree

- Work 40 years

- Hope it all works out

Spoiler: It doesn’t, at least not for most.

The Trade-Off That Rules the System

Say you want to escape that fate. You need net worth that supports your lifestyle, gives you freedom, and protects your family.

You have three levers to pull: time, risk, and money. Which one will you lean on?

Option 1: Leverage Time

If you’re young and just starting out, time is your greatest asset, even if your income is low.

By investing early and consistently, you reduce your dependency on high risk or high earnings. Time smooths out market volatility. Compound interest amplifies small inputs.

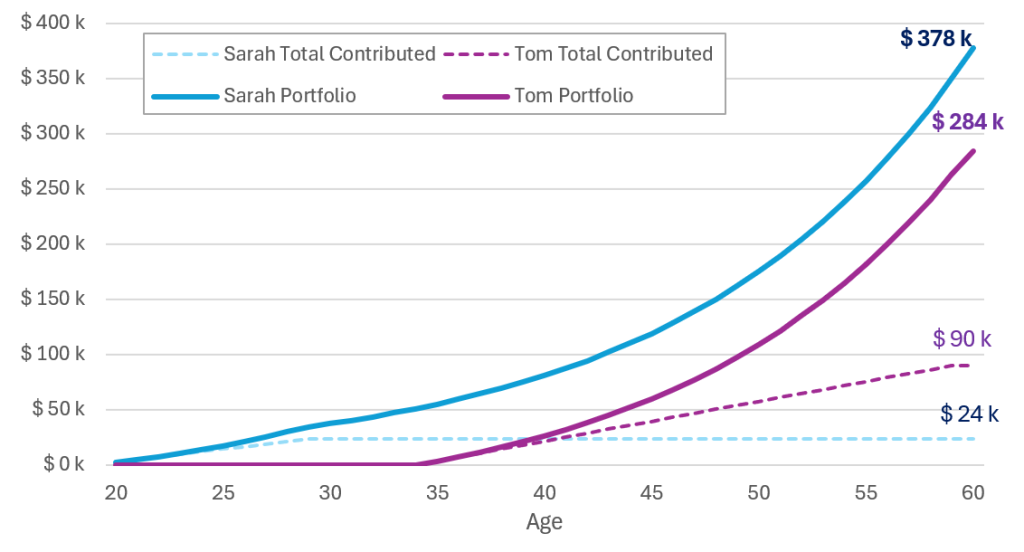

Have a look at these examples, both assuming an at 8% annual return:

Sarah

- Starts investing: Age 20

- Stops contributing: Age 30

- Invests: $200/month ($2,400/year) for 10 years

- Total invested: $24,000

- Let it grow until age 60 without adding anything

- Value at age 60: ≈ $377,844

Tom

- Starts investing: Age 35

- Invests: $300/month ($3,600/year) for 25 years

- Total invested: $90,000

- Value at age 60: ≈ $284,236

Sarah ends up with more money, even though she invested far less.

Why? Time.

You can’t buy more time later. Once it’s gone, it’s gone.

Option 2: Leverage Risk

If you’re older or playing catch-up, you need faster growth, and that means more risk.

This doesn’t mean gambling blindly. It means understanding what intelligent risk looks like:

- Startup equity or small-cap stocks

- Leveraged real estate

- Bitcoin and emerging tech

Yes, the volatility is higher. And yes, many fail chasing these. But when done with research, patience, and clear goals, it’s still a valid path.

Just be aware that it will require much more effort and risk than option 1.

Option 3: Leverage Income

Let’s say time isn’t on your side, and you’re risk-averse.

That means you’ll need to increase your income.

This might mean:

- Scaling a high-paying skill or building a side hustle

- Launching a business

- Switching industries for better ROI on your time

If you can consistently save and invest larger amounts, you make up for lost time and avoid excessive risk.

But be warned: more money won’t solve the problem if you don’t use it strategically.

The Common Path to Nowhere

Most people don’t use any of these levers.

Often starting late, with fear of risk, and no plan whatsover to increase income.

And worse of all, they even think their savings account will be “enough”.

But 30 years later, inflation has eaten their value. Their bank account was safe, but it lost the power to make any difference.

They didn’t invest or grow.

Just waited.

And time didn’t wait with them.

Break the Pattern

So what should you do instead?

Master the ABCs:

- Assess risk, don’t fear it by default.

- Build assets and wealth steadily over time.

- Cultivate discipline, skills and systems.

Ask yourself honestly:

- Can I give this more time?

- Can I earn more money?

- Can I tolerate more risk?

Pick your lever(s).

If you pick none, the system picks for you, and it rarely picks kindly.

From Knowledge to Freedom

Most people live inside this relationship without realizing it.

They drift, delay, or deny the math.

Until one day, they sit quietly wondering where the years went and why the bank account never added up to freedom.

But you?

You’re ahead.

Now you understand the Time–Money–Risk trade-off.

Now you can leverage it.

Because this isn’t just about finance.

It’s about freedom.

Leave a Reply